Follow these steps to determine your eligibility for the HHFDC Housing Program at Kahuina.

- Watch the ‘Kahuina Affordable Housing Webinar’ to learn more about Kahuina and the HHFDC Sales Program.

- a) Download an Information Packet (includes HHFDC requirements, Project information, and required supplemental forms). Download Here.

b) Download an Application Packet. Download Here. - Gather your financial documents.

- Meet with a project-approved lender to obtain a pre-qualification letter. Learn More.

- Create your account to upload documents to the Kahuina HHFDC Housing Program portal. Create Account.

- Upload your completed application and all required supplemental forms (completed, signed, and notarized if required) to a personalized client portal. Login to Client Portal.

- Send an email to apply@mykahuina.com with the subject “Notice: HHFDC Application Documents Submitted” and include the primary applicant’s legal name and email address in your email body once all required documents have been uploaded to the Client Portal. *This will serve as your time stamp for submitting your application.

- Be on the lookout for your HHFDC approval.

- Select your unit.

- Sign a contract for your new home.

If your supplemental forms require a notary, please feel free to contact Title Guaranty.

If you have any questions regarding your application, please feel free to contact us at apply@mykahuina.com or call us at 808.229.3800.

HHFDC Pricing

Prices vary based on floor plan, square footage, floor level, etc. See table below and contact a sales team associate for further details.

Bedroom

SQ. FT.

Price

1 Bedroom

507 – 620 sq. ft.

Starting at $598,888

2 Bedroom

707 – 711 sq. ft.

Starting at $692,800

3 Bedroom

1,076 sq. ft.

Starting at $839,900

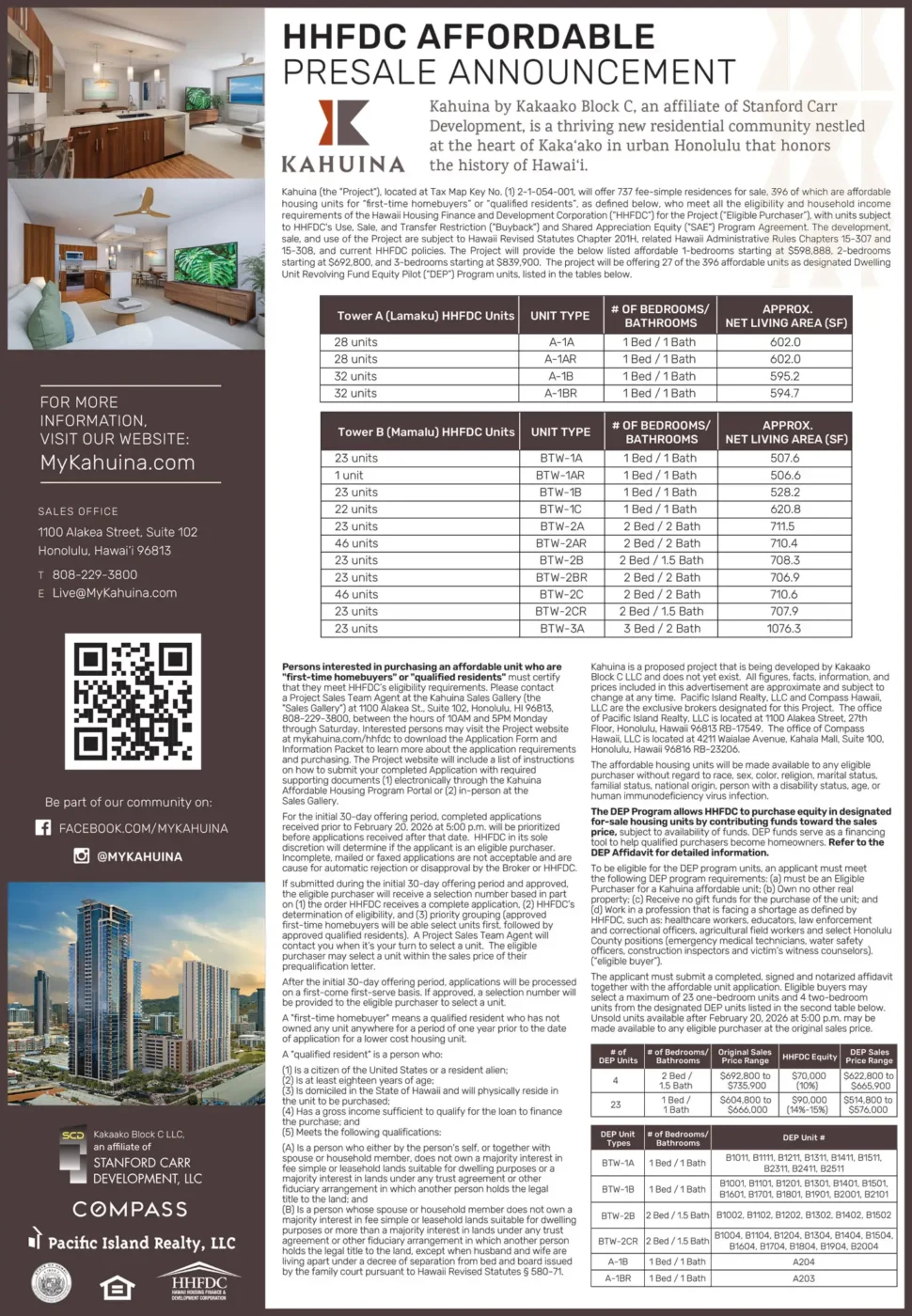

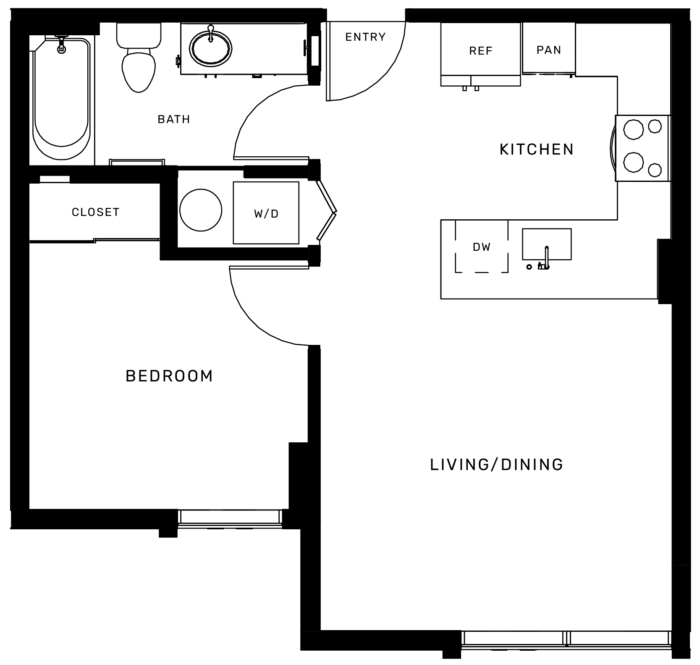

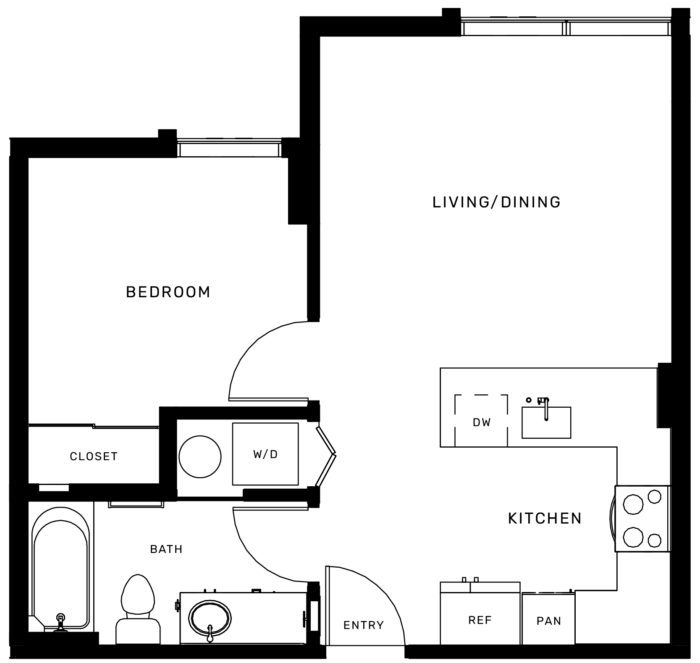

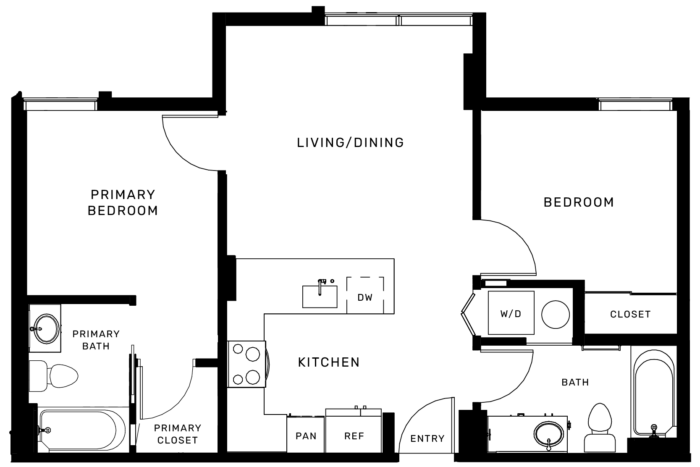

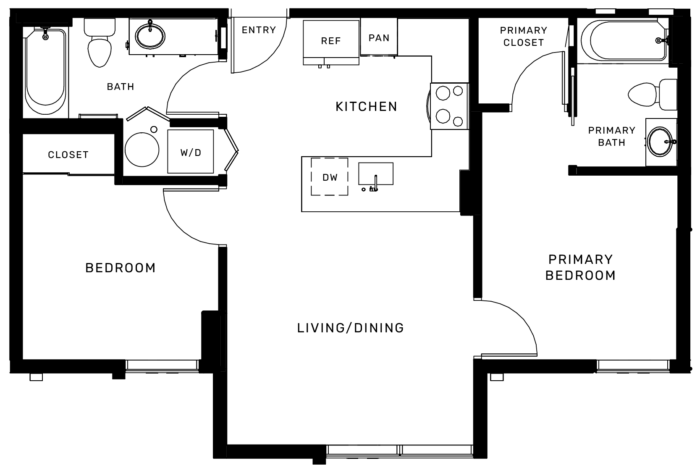

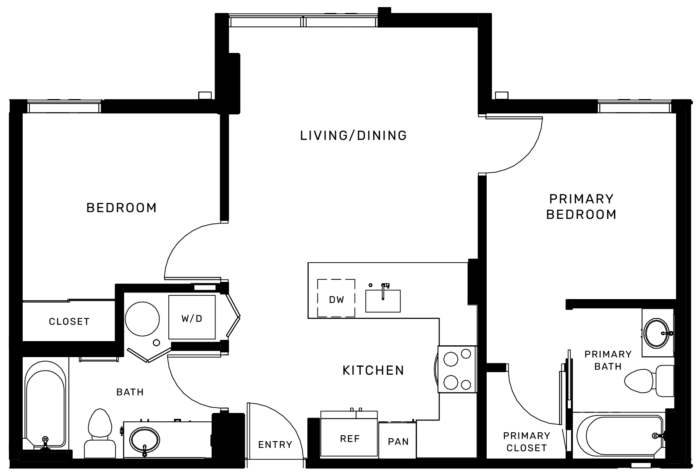

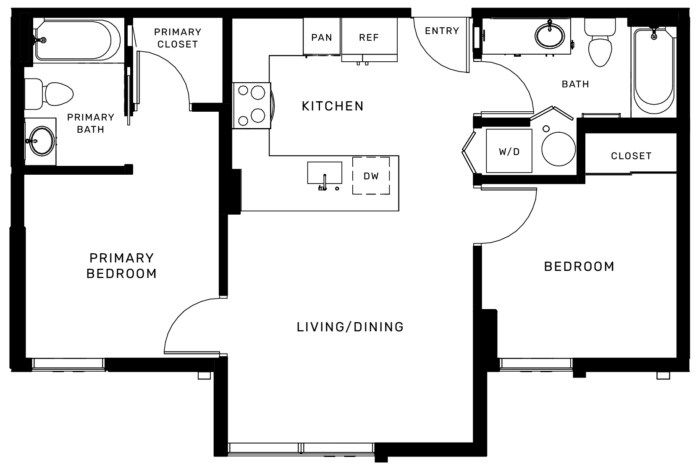

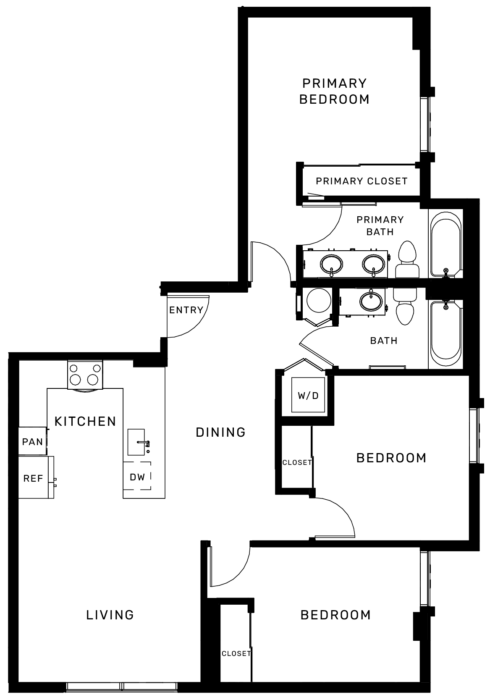

HHFDC Housing Floor Plans

READ OUR

Frequently Asked Questions

The Hawai‘i Housing Finance and Development Corporation (HHFDC) is the primary agency charged with overseeing housing, financing, and development in Hawai‘i. For this project, it administers the State 201H housing program. Its website is https://dbedt.hawaii.gov/hhfdc/.

- Allows eligible and qualified applicants to purchase at below market prices

- Homebuyers have an opportunity to live in the heart of Kaka‘ako at a brand new development that fits their budget

- Prices are set by the HHFDC based upon area median income rather than market pricing

- Share in future appreciation of your home

- Home ownership which includes many benefits such as stabilized monthly payments

The HHFDC will determine eligibility based on the information you provide in your Application Packet, including the following:

- First-time homebuyer or Qualified Resident

- US Citizen or permanent resident alien

- At least 18 years of age

- Is domiciled in the State of Hawai‘i and will physically reside in the unit purchased

- Does not own a majority interest in a fee simple or leasehold property suitable for dwelling purposes anywhere in the world

- Does not have income exceeding 140% AMI

- Has sufficient gross income to qualify for the loan to finance the purchase

- Has household assets for initial deposit and down payment

- Demonstrates a need for housing in accordance with state law

HHFDC Housing is for buyers earning 140% and below of the Area Median Income.

| HOUSEHOLD SIZE | 140% of AMI |

|---|---|

| 1 Person | $148,960 |

| 2 Person | $170,240 |

| 3 Person | $191,520 |

| 4 Person | $212,800 |

| 5 person | $229,880 |

| 6 Person | $246,960 |

No.

Gift funds are allowed to assist in the down payment. May not exceed 35% of the purchase price and they must be from a relative.

Co-signing is allowed to help with qualifying for your mortgage. As long as the co-signer is not living in the home, they are not included in the eligibility requirements.

The buyer will need to provide $1000 at contract signing and the remainder of 5% minus the $1000 after 30 days.

The buyback program ensures the home remains affordable for a minimum of 10 years and gives the HHFDC or a qualified non-profit entity the first option to purchase the property in the event of a sale or transfer during the first 10 years of ownership. Owner occupancy is required during this period. The restriction automatically terminates 10 years from the date the deed transferring ownership to the buyer, is recorded. HHFDC prior written consent is required for certain activities related to use, refinance, sale and transfer of the property.

SAE is Shared Appreciation Equity. This is the sharing of the property’s appreciation with the HHFDC in exchange for the buyer’s opportunity to purchase at below market prices. The SAE percentage is calculated prior to closing and once determined, does not change. Owner occupancy is required during this period. SAE does not have an expiration date. It must be paid and released by filing a release document at the Bureau of Conveyances.

The SAE must be paid when the property is sold, transferred or rented. Owners may pay it off at any time after recordation.

You can pay SAE at any time after becoming the owner by submitting a written request of your intentions to the HHFDC. This does not affect thebuyback requirement. Regardless of when you pay the SAE, you must still live in the purchased unit for a minimum of 10 years.

The HHFDC will require documentation to support your application. Refer to the Application Packet checklist. Some examples are: current year tax returns, W-2, two months of paystubs, and a letter of pre-qualification from a Lender. Lenders will have different requirements to determine loan pre-qualifications.

The standard formula is: Original Fair Market Value (determined by appraisal prior to closing), minus Original Purchase Price, divided by Original Fair Market Value, and rounded to the nearest one percent.

Yes, any eligible purchaser can buy any home they are financially qualified for.

HHFDC recertification is required if there is any change to the identity of the eligible purchaser(s) or to property ownership occurring between the date of HHFDC’s approval letter and the closing of the property purchase. For purposes of this requirement, “identity” refers solely to the approved buyer(s) named in HHFDC’s approval letter and does not include changes in marital status, income, or household size.